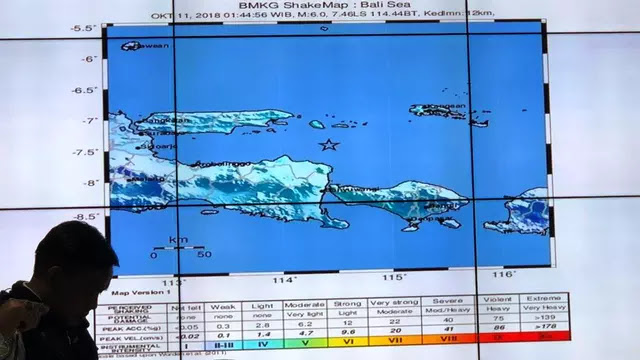

Badan Meteorologi, Klimatologi, dan Geofisika (BMKG) menyebut gempa Situbondo, Jawa Timur, yang terjadi pukul 01.44 WIB, disebabkan oleh sesar naik Flores. Hasil penelitian ilmuwan, sesar tersebut memang sedang aktif di beberapa bagian.

"Ini sesar naik yang ada di Flores memang lagi aktif di beberapa tempat," ujar Deputi Bidang Geofisika BMKG, Muhamad Sadly, di kantor BMKG, Jakarta, Kamis (11/10/2018).

Kepala Pusat Gempa Bumi dan Tsunami BMKG, Rahmat Triyono mengatakan, aktifnya sesar naik Flores ini disebabkan oleh pengaruh tumpukan tiga lempeng yang juga sedang aktif. Kondisi ini, lanjut dia, sangat menarik karena unik. Oleh karena itu, perlu dibuat peta baru tentang sesar tersebut.

Kepala Pusat Gempa Bumi dan Tsunami BMKG, Rahmat Triyono mengatakan, aktifnya sesar naik Flores ini disebabkan oleh pengaruh tumpukan tiga lempeng yang juga sedang aktif. Kondisi ini, lanjut dia, sangat menarik karena unik. Oleh karena itu, perlu dibuat peta baru tentang sesar tersebut.

"Melihat pagi ini ada aktivitas gempa di antara Situbondo dan Sumenep, maka tampaknya memang berdasarkan dari pola mekanismenya ada hubungan benang merah yang ada di Flores. Ini menjadi kejadian yang menarik, perlu dipetakan dan perlu dibuat peta baru," tutur Rahmat Triyono.

Dia menjelaskan Indonesia memang masuk dalam kawasan seismik aktif dan kompleks. Ada 6 zona subdaksi di Tanah Air.

"Masing-masing zona subdaksi masih dirinci lagi menjadi segmen-segmen megathrust yang berjumlah 16. Sesar aktif teridentifikasi 295 sumber gempa sesar aktif," lanjut Rahmat dalam konferensi pers soal gempa Situbondo.

Badan Meteorologi Klimatologi dan Geofisika (BMKG) mencatat ada 14 kali lindu susulan usai gempa Situbondo, Jawa Timur bermagnitudo 6,3 yang mengguncang Kamis dini hari tadi. Namun, kekuatan lindu susulan ini tidak sebesar gempa Situbondo pukul 01.44 WIB tadi.

"Kekuatan gempa terus mengecil. Kekuatannya magnitudo 2,5-3,5 ya," ujar Humas BMKG Hary Djatmiko, saat dihubungi Liputan6.com, Jakarta, Kamis (11/10/2018).

Oleh karena itu, BMKG mengimbau agar masyarakat tetap tenang. Namun, warga juga harus tetap waspada.

There is a characterized minute when a significant number of us begin to consider getting extra security to ensure relatives and friends and family. It could be after a labor or an infectious protection business that changes your advantage. At the point when this minute strikes, the principal thing a great many people do is get a speedy online statement to comprehend their ballpark rates. A more point by point evaluation takes after a short time later. A few components of this appraisal are instinctive (age, wellbeing condition, smoking status, occupation, and so on.). There are, in any case, some other amazing appraisal criteria that financiers additionally consider. For example, Driving History: Yes, your driving history matters, for your accident coverage premiums as well as your extra security rates. In the event that you had a DUI mishap in the ongoing past, you will probably encounter noteworthy higher cited rates than some individual who has a perfect driving history. Keep in mind that littler offenses tumble off your driving record following three years (for protection purposes). Be Happy: Having a past filled with dejection can seize your life coverage premiums, nearly multiplying them. Upbeat individuals encounter less medical problems and stress, and in this manner speak to bring down hazard for insurance agencies. Arrangement Date: The strategy's beginning date can be at times balanced (likewise called antedating), implying that now and again you can profit by bring down premiums (in light of your more youthful age; on the off chance that you turned 50 this week yet predate your approach to a month ago, for instance). Clearly you should pay all the premiums beginning from the predated time point, however you can profit by a lower rate going ahead. Perilous employments (e.g. stand-ins, bomb squad part) can mean higher hazard for your life and along these lines prompt higher protection premiums. Do you feel that your activity is hazardous? Installment recurrence: Paying for an extra security approach on a yearly premise spares safety net providers regulatory expenses, and they remunerate you with bring down premiums than if you'd paid for your protection month to month. For this situation, however, you'd have to design deliberately on the grounds that a major yearly charge can make a noteworthy gap in your family spending plan on the off chance that you disregard the yearly premium. Voyaging (to hazardous goals): Some goals are more perilous than others and some are exceptionally risky (battle areas, territories with known history of hijacking, and so forth.) Consult a protection representative or your specialist to see how your tentative arrangements can affect your protection scope. Your approach can be declined or you may have the capacity to find a hobby protection arrangement, however it would unequivocally reject the time you are abroad. Now and again, a disentangled issue no medicinal extra security approach is an answer since it doesn't ask travel questions. It is essential to know, however, that a rearranged issue strategy is more costly than a standard one and its scope is normally constrained to $50,000 - $300,000. You can test this out by getting a mysterious improved issue no restorative life coverage quote by means of one of various protection online stages. Games (extraordinary): Being associated with outrageous as well as unsafe games, particularly professionally, can affect your disaster protection premiums (for instance: sky plunging, bluff jumping, scuba plunging). Correspondingly to getting protection while venturing out to hazardous areas, you have to comprehend which cases are not secured by your life coverage approach. Private pilot licenses: This one more often than not falls into a class of hazardous interests - authorized pilots (just private) may encounter higher protection rates. While ascertaining protection premiums, a back up plan will consider both the pilot's age and experience. This data will likely not asked amid the underlying citing process, but rather will be required amid the point by point evaluation later. Your citizenship: If you are not a Canadian subject or inhabitant, you won't have the capacity to apply for a Canadian extra security approach. Your salary: Insurance organizations can decrease your disaster protection arrangement if your family unit wage falls underneath a specific limit, ordinarily $30,000. The thinking behind this is so protection does not extend your financial plan past its capacities. Note that you should in any case talk with an intermediary to make a definite future arrangement for protection insurance, and facilitates that are additionally money related organizers can help you triage your up and coming budgetary costs to best deal with your necessities. It's a smart thought to check with your protection representative, if your salary may be an issue, before presenting your application. Keep in mind, that once you have been declined for a life coverage application, it might affect your next applications since a few safety net providers incorporate into their overviews, "have you at any point been declined for an extra security application?" Similarly to a pilot permit, this inquiry may be not be incorporated into starting statement questions, but rather will be asked later by your back up plan. As should be obvious, numerous angles outside of your wellbeing sway your life coverage statement and arrangement. You ought to recollect that endorsing rules (application appraisal) are diverse crosswise over safety net providers and in this manner, it is fitting to work with a protection intermediary who manages various life coverage organizations and can share his/her aptitude with you as you explore through this mind boggling process. These bits of knowledge have been shared by Alexey Saltykov, fellow benefactor of InsurEye.com, the Canadian web stage that offers autonomous shopper audits database for various sorts of life security and gives shabby basic sickness ( https://insureye.com/basic ailment protection quote/) and term extra security cites ( https://insureye.com/term-life coverage cites/).